It was too quiet to last. A sustained and brutal destruction of capital in India’s telecom industry was only just starting to give way to a period of peace and calm. The three operators who survived out of the dozen on the scene in 2016 must have been grateful for the end to a debilitating price war. Stable market shares and decent per-user revenue would support the next round of investment.

So imagine the anxiety that bubbled up on the news that billionaire Gautam Adani — the port and airport owner who’s so far had nothing to do with telecom — will bid for 5G spectrum in this month’s auction.

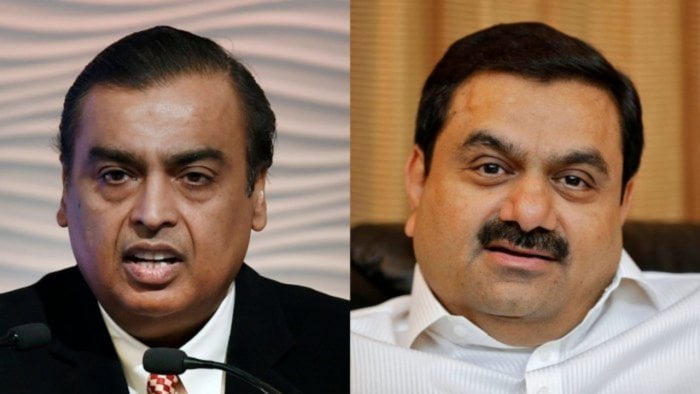

Six years ago, it was another tycoon — Mukesh Ambani — who disrupted India’s wireless market with cheap data and free calls. He’s now the market leader with 410 million subscribers. To core telco revenue, add services like digital advertising, e-health and mobile education, where big rewards are still some years away. All told, Ambani’s Jio Platforms Ltd., in which Meta Platforms Inc. and Alphabet Inc. are investors, is a $95 billion enterprise, 17 per cent bigger than the hydrocarbons empire he inherited from his dad, according to Jefferies.

Should Ambani now prepare for an Adani assault? They’re rivals who have so far managed to move in separate orbits. Ambani built upscale consumer businesses like telecom and retail to shed the group’s overdependence on refining and petrochemicals. Adani went after industrial and utility-scale customers in transportation, coal and power. But they now have overlapping ambitions, for instance in renewables and media. Analysts at Motilal Oswal in Mumbai are noticing a “consumer bent” within the Adani group, which could extend beyond owning the country’s No. 1 edible oil brand. Could telecom become a battlefield for two of the world’s richest people?

The Adani group is ruling out any such plans. Analysts, too, are skeptical if it’s worth fighting over the sector. Bank of America says there’s no viable business case for any non-4G telco in consumer mobility given low tariffs, limited room to differentiate, inadequate spectrum and lackluster returns on investment. Jio and Bharti Airtel Ltd., the No. 2 player, are on a strong wicket financially. Vodafone Idea Ltd. has skirted bankruptcy or slump sale — the fate that befell several other players — thanks to a state-mounted rescue. If Adani does decide on a full-fledged telecom entry by buying the struggling No. 3 player, it will still require billions of dollars of capital expenditure to backfill the telco’s missing investment. And for what? Just $2 per month per subscriber, which is what Jio is making now? It doesn’t seem like an efficient use of the debt financing that propels the Adani juggernaut. The scope for a new telco is only in the enterprise space, the Bank of America analysts say.

There’s some support for that view. For one thing, 5G will be a good fit for Adani’s ambitious renewable-energy play. That $70 billion investment commitment has two sides to it: Producing clean power and investing in data centers — “the largest energy-consuming industry to ever exist,” he said at last year’s Bloomberg India Economic Forum. Pairing high-speed spectrum with a data center makes sense.

Other in-house businesses, such as a planned super-app, could also benefit. “We are participating in the 5G spectrum auction to provide private network solutions along with enhanced cybersecurity in the airport, ports and logistics, power generation, transmission, distribution, and various manufacturing operations,” the Adani group said in a press statement, adding that the airwaves it wins at the auction may also be deployed in education, health care and skill development. The founder and his family recently announced that they would donate Rs 60,000 crore ($7.7 billion) to Adani Foundation, the philanthropy that would spearhead the social investments.

Still, it’s unclear why Adani wants to join the auction when his operation can — as a captive non-public network — ask to be assigned spectrum by the government for 10 years without having to pay any license or entry free. “Spectrum acquired through auctions is expensive because it is eligible for commercial services,” Jefferies researchers say. Since Adani is taking this route, it’s fair to ask if this isn’t a backdoor entry into consumer wireless. Ambani had followed the same playbook. In 2010, he acquired a tiny, obscure company that had surprised everyone by submitting the winning bid to offer broadband internet (but no phone calls) across India. In 2013, the government allowed voice services on the spectrum and Reliance got itself a pan-India license. That’s how Ambani entered telecom. There’s nothing to rule out a repeat — this time by his rival.

Speculation about Adani’s actual intentions in telecom won’t end even if he puts up a modest show at the auction. If the 60-year-old, first-generation industry magnate from Prime Minister Narendra Modi’s home state of Gujarat only wants to target enterprise-level customers, then he doesn’t need to spend $4 billion or more for buying 100 megahertz of spectrum across India. On the other hand, if he does want to get into consumer wireless, now’s too early to show his cards.

After getting hold of the spectrum in 2010, Ambani took six years to set up his network and yet caught his rivals napping. Could Adani’s ultimate goal be to exploit bankers’ and investors’ memory of the carnage that took place after Ambani’s 2016 entry? He could, in theory, raise the cost of capital for the entire industry — by keeping the market guessing about a possible clash of titans. Just the threat that Adani might eventually come after the $2-per-month customer could see capital-starved Vodafone Idea buckle, in which case he could swoop in on it later. There’s nothing more disquieting for an industry than to know that the hard-won peace will probably not last long.